In 2025, interest-only mortgages in Miami are gaining attention among homebuyers and investors seeking lower initial monthly payments in a competitive housing market. With Miami’s real estate prices continuing to rise, these loans can make homeownership more accessible—or more risky—depending on the borrower’s long-term financial plans.

This guide breaks down the pros and cons of interest-only mortgages so you can decide whether this financing option is right for your 2025 Miami property purchase.

What Is an Interest-Only Mortgage?

An interest-only mortgage allows borrowers to pay only the interest portion of the loan for a set period—usually 5, 7, or 10 years—before switching to regular payments that include both principal and interest.

In Miami’s high-demand real estate market, this structure can help buyers afford larger or more desirable properties upfront. However, it’s not without trade-offs.

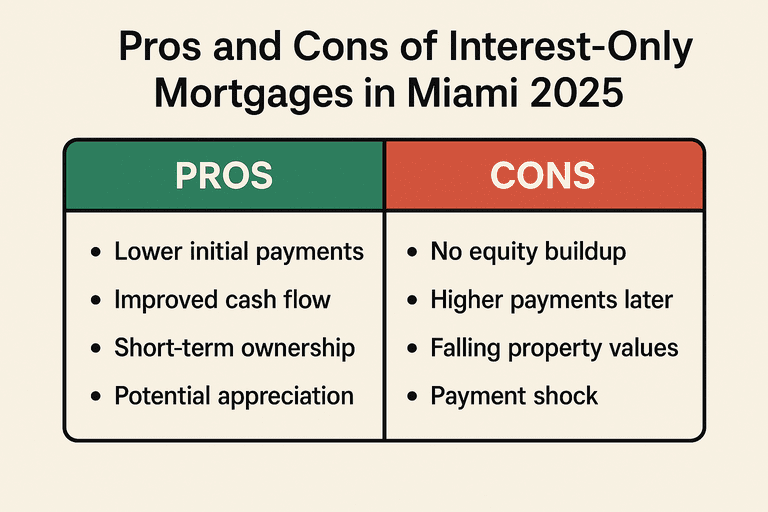

Pros of Interest-Only Mortgages in Miami 2025

1. Lower Initial Monthly Payments

During the interest-only phase, monthly payments can be significantly lower compared to traditional mortgages. This can help buyers manage cash flow or invest in renovations.

2. Increased Buying Power

Lower initial payments may allow you to qualify for a larger loan amount, opening the door to premium neighborhoods like Brickell, Coconut Grove, or Miami Beach.

3. Flexible Investment Strategy

For real estate investors, interest-only loans can free up capital for other investments, short-term flips, or rental property improvements.

4. Potential Tax Advantages

Mortgage interest may be tax-deductible (consult a tax advisor), which can enhance the financial benefits during the interest-only phase.

Cons of Interest-Only Mortgages in Miami 2025

1. No Equity Built During the Interest-Only Period

Without principal payments, your equity won’t grow unless property values rise—something not guaranteed.

2. Higher Payments Later

When the interest-only term ends, monthly payments increase sharply as you begin repaying the principal.

3. Market Risk in Miami

If the Miami real estate market cools or declines, you could owe more than your home is worth, especially if no equity has been built.

4. Stricter Lending Requirements

In 2025, many lenders require higher credit scores, substantial down payments, and proof of income stability for interest-only loans.

Who Should Consider an Interest-Only Mortgage in Miami?

Interest-only mortgages aren’t for everyone. They can be a strategic fit for:

-

High-income professionals expecting future income growth.

-

Real estate investors planning to sell before the interest-only period ends.

-

Short-term residents who will relocate within 5–10 years.

Alternatives to Interest-Only Mortgages

If you’re concerned about the long-term risks, consider:

-

Adjustable-Rate Mortgages (ARMs) – Lower initial rates, but principal payments start immediately.

-

FHA Loans – Lower down payments and flexible credit requirements.

-

15-Year Fixed Loans – Faster equity build-up with lower lifetime interest costs.

Miami Market Considerations for 2025

Miami’s property market remains one of the most dynamic in the U.S., with demand driven by out-of-state buyers, international investors, and ongoing development. However, rising interest rates and evolving economic conditions could make interest-only loans both more appealing for cash flow and riskier for long-term stability.

Local tip: Work with a Miami mortgage broker who understands both the market cycles and lender requirements for interest-only products.

Final Thoughts

The pros and cons of interest-only mortgages in Miami 2025 hinge on your financial goals, market outlook, and ability to handle higher payments in the future. While they offer flexibility and lower initial costs, they also carry the risk of delayed equity and payment shocks.

For the best outcome, assess your income stability, property plans, and risk tolerance—and consult a mortgage expert before committing.

Local Resource: My Miami Mortgage Broker offers personalized guidance on interest-only loans and other mortgage solutions for Miami buyers in 2025.