Most Miami buyers obsess over the interest rate and ignore the pricing behind it. That’s how people accidentally overpay.

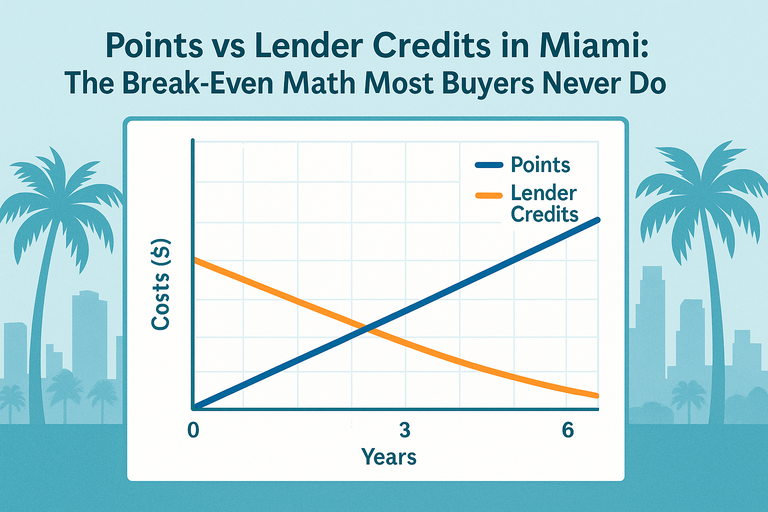

Here’s the clean truth: you’re always choosing between paying more upfront (discount points) to get a lower rate, or paying less upfront (lender credits) and accepting a higher rate. The smart move depends on one thing: how long you’ll keep the loan.

Definitions (no fluff)

Discount points: Upfront fee paid to lower your interest rate. Typically, 1 point = 1% of the loan amount (example: 1 point on a $500,000 loan = $5,000). The actual rate reduction per point varies by market.

Lender credits: The lender covers some of your closing costs in exchange for a higher interest rate. Great for cash-tight buyers. Bad for people who keep loans a long time.

The only formula that matters: break-even time

Step 1: Find the “extra cash” you’re paying upfront

This is the difference in total closing costs between the two options.

Example:

- Option A (lower rate): costs $6,000 more at closing (because you paid points)

- Option B (higher rate): costs $0 extra upfront (or even gives you credits)

So your extra upfront cost = $6,000

Step 2: Find monthly savings of the lower rate

Monthly savings = (monthly payment with higher rate) – (monthly payment with lower rate)

Example:

- Higher rate payment: $3,550

- Lower rate payment: $3,420

Monthly savings = $130

Step 3: Break-even months

Break-even = extra upfront cost ÷ monthly savings

= $6,000 ÷ $130 = 46.15 months

That’s about 3 years and 10 months.

If you’ll keep the loan longer than ~46 months, points likely win.

If you’ll refinance/sell sooner, credits likely win.

This is the math most people never do—and it’s why they lose.

Miami reality check: why break-even often gets shorter (or longer)

Points tend to make sense if:

- You’re buying a long-term primary residence

- You’re stable in Miami (not “maybe we move in 2 years”)

- You don’t expect refinancing soon

- You have strong cash reserves after closing

Lender credits tend to make sense if:

- You’re cash tight and need help closing

- You’re buying short-term (starter home, relocation, uncertain timeline)

- You believe you’ll refinance within 1–3 years

- You’re dealing with heavy Miami closing costs (insurance + escrow + HOA friction)

- https://mymiamimortgagebroker.com/rent-vs-buy-calculator-make-the-smartest-housing-decision/

The hidden traps people miss (read this twice)

Trap #1: “I’ll refinance soon anyway”

That’s not a plan. That’s a hope. Refinancing depends on:

- your income stability

- property value

- credit

- market rates being better

If rates don’t drop, you could be stuck with the higher-rate choice longer than you expected.

Trap #2: Points aren’t always fully recoverable

If you sell early, you don’t get “refunds” on points. You just paid extra for savings you never had time to realize.

Trap #3: Credits can mask expensive rates

Some lenders make offers look attractive by throwing credits at you while quietly charging a worse rate. You feel good at closing and bleed money monthly for years.

The practical way to choose (fast decision framework)

Pick points if:

- You expect to keep the mortgage 5+ years

- You have enough cash that paying points doesn’t wipe out reserves

- You want predictable long-term payment savings

Pick lender credits if:

- You expect to keep the mortgage under 3–4 years

- Cash-to-close is your biggest constraint

- You’re planning a likely refinance (and you accept the risk that it may not happen)

If your expected timeline is 3–5 years, don’t guess—run break-even using your lender’s exact numbers.

What to request from your lender/broker (non-negotiable)

Ask for a quote that shows at least 3 pricing options on the same day:

- Par rate (no points, minimal credits)

- Lower rate with points

- Higher rate with credits

Then compute break-even between #2 and #3. If they won’t provide side-by-side options, you’re not comparing—you’re being sold.

Bottom line

Points vs credits is not about “getting the best rate.” It’s about buying the cheapest loan for your timeline.