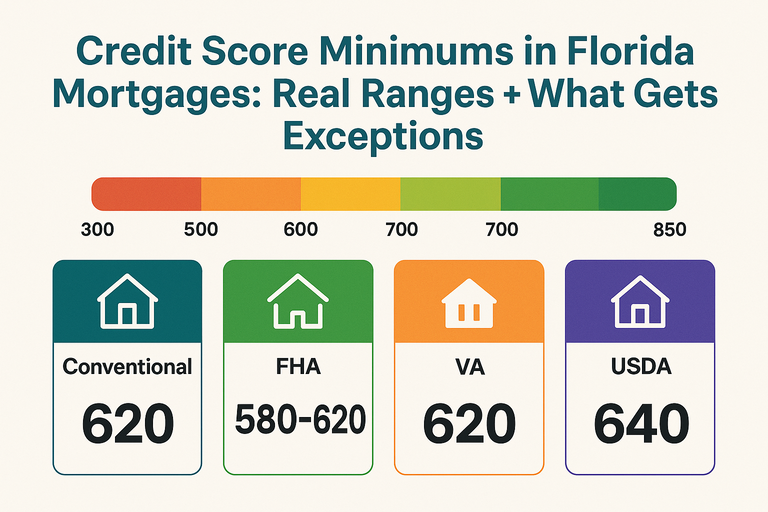

Florida doesn’t have special “state credit-score rules.” What matters is loan type + lender overlays + your full risk profile (DTI, down payment, reserves, documentation). Here are the real ranges that actually show up in approvals—and the few situations where exceptions happen.

FHA loans (owner-occupied): the clearest official floor

FHA has an explicit minimum:

- 580+: eligible for maximum financing (commonly the 3.5% down structure) (answers.hud.gov)

- 500–579: still potentially eligible, but lower maximum financing (effectively more down payment required)

- <500: not eligible for FHA-insured financing

What gets “exceptions” on FHA?

Not below 500 (that’s a hard stop). The “exception” is usually getting an AUS approval above the basic manual-underwrite comfort zone because you have compensating factors: strong cash reserves, low DTI, stable income, minimal payment shock, or larger down payment.

VA loans: VA doesn’t set a minimum, lenders do

The VA program itself does not require a minimum credit score, but lenders still evaluate credit history and set their own thresholds.

Real-world range you’ll see most often: many VA lenders commonly look for ~620, though some will go lower with tighter scrutiny.

What gets exceptions on VA?

VA can be more forgiving when the rest of the file is strong (steady income, residual income, low debt load, clean recent history). But “exception” here usually means: manual review + more documentation, not magic approval.

Conventional (Fannie/Freddie): “620” used to be the headline—now it’s more complicated

Conventional underwriting is increasingly automated, and the old “everyone needs 620” narrative is not as clean as it used to be.

- Fannie Mae’s guidelines emphasize that DU evaluates overall risk, while lenders still obtain credit scores as part of the process.

- As of mid-November 2025, industry reporting indicates Fannie Mae removed the hard 620 minimum requirement for loans submitted through DU starting around Nov. 16, 2025.

Translation (important): even if the old floor is gone in the automated system, most lenders will still have overlays (internal minimums) and pricing adjustments. So you may be “eligible,” but priced badly—or declined by that lender.

Real-world range you’ll still see a lot: 620–740+ is where conventional gets easier and cheaper; below that gets harder and more expensive fast.

Non-QM (bank statement, asset-based, investor programs): lender-by-lender

Non-QM doesn’t have one universal minimum. Each lender sets rules.

Real-world ranges: many Non-QM programs often look for something like 600–660+, but it depends heavily on:

- down payment size

- reserves

- recent late payments

- bankruptcy/foreclosure timing

- documentation quality

“Exceptions” in Non-QM usually come from bigger down payments, more reserves, or a cleaner recent 12–24 month credit pattern. If your recent history is messy, you’re not negotiating—you’re paying.

What actually earns an exception (across loan types)

If you’re trying to get approved with a weaker score, these are the levers that genuinely move decisions:

- More down payment (reduces lender risk)

- More reserves (months of payments in the bank)

- Lower DTI (room in your budget)

- Clean recent history (last 12 months matters more than old scars)

- Explainable credit events (documented, isolated, and resolved)

- Fix errors / rapid rescore if your report is wrong (not “credit repair vibes,” real corrections)

For practical steps, you already have a relevant resource:

https://mymiamimortgagebroker.com/credit-repair-strategies-miami-mortgage-rates/

And if you want to stop getting “sold” and start controlling the process, use this before you apply:

https://mymiamimortgagebroker.com/questions-to-ask-a-mortgage-lender-before-applying/

Bottom line

- FHA: hard floor at 500, best terms typically 580+.

- VA: no VA minimum, but lenders set one (often around 620).

- Conventional: the “620 minimum” is less absolute than before; lender overlays still rule your outcome.

- Non-QM: flexible, but you pay for risk unless you offset it with cash/down/reserves.