Explore The Latest News and Advice

How Much Cash Do You Need to Close in Miami? (Down Payment + Reserves + Closing Costs)

Most Miami buyers underestimate cash-to-close because they fixate on the down payment and forget the rest: closing costs, escrows, and sometimes reserves. Then they’re shocked a week before closing. Here’s how to estimate it properly—without wishful thinking. The 3 buckets of money you need 1) Down payment (varies by loan

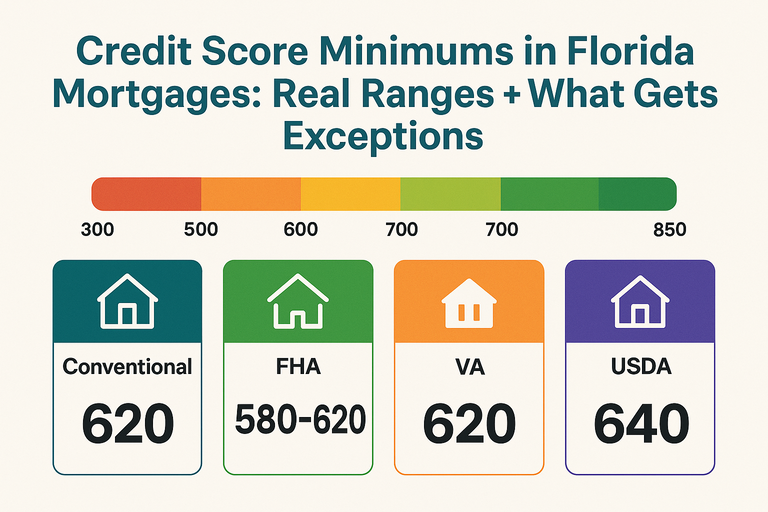

Credit Score Minimums in Florida Mortgages: Real Ranges + What Gets Exceptions

Florida doesn’t have special “state credit-score rules.” What matters is loan type + lender overlays + your full risk profile (DTI, down payment, reserves, documentation). Here are the real ranges that actually show up in approvals—and the few situations where exceptions happen. FHA loans (owner-occupied): the clearest official floor FHA

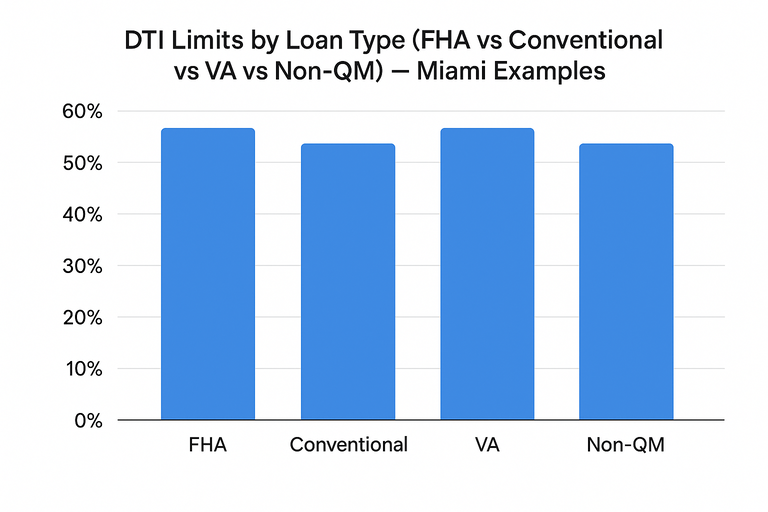

DTI Limits by Loan Type (FHA vs Conventional vs VA vs Non-QM) — Miami Examples

DTI (debt-to-income ratio) is the percentage of your gross monthly income that goes to monthly debt payments. Lenders use it to judge whether your payment is sustainable—especially in Miami, where HOA dues + insurance can blow up the “housing payment” number. DTI formula: DTI = (monthly housing payment + monthly

2-1 Buydowns in Miami: Who Pays, How It’s Priced, and When It’s Worth It

A 2-1 buydown is one of the most misunderstood tools in Miami real estate. People pitch it like “cheap money.” It’s not. It’s a temporary payment discount that somebody funds upfront—usually to help a buyer qualify or to make a high-rate market feel tolerable. Used correctly, it’s smart. Used blindly,

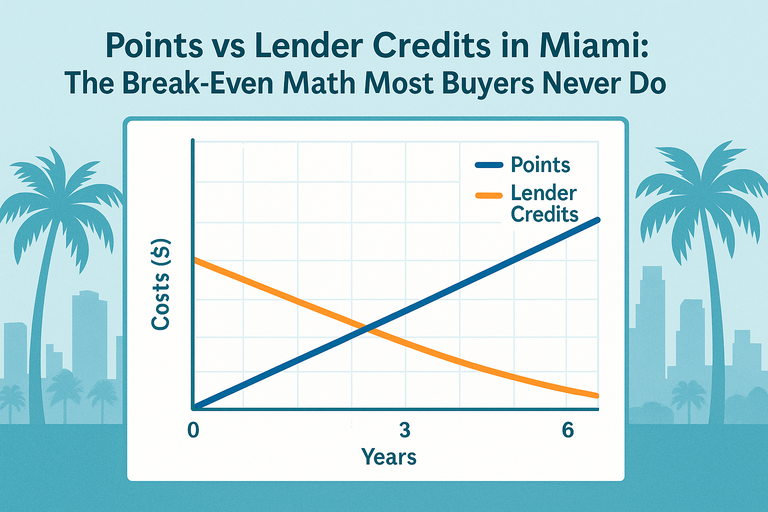

Points vs Lender Credits in Miami: The Break-Even Math Most Buyers Never Do

Most Miami buyers obsess over the interest rate and ignore the pricing behind it. That’s how people accidentally overpay. Here’s the clean truth: you’re always choosing between paying more upfront (discount points) to get a lower rate, or paying less upfront (lender credits) and accepting a higher rate. The smart

Large Deposits & Bank Statements: How to Document Your Money Without Delaying Closing

Large deposits are one of the most common reasons a Miami mortgage file gets stuck in underwriting. Not because the money is “bad,” but because lenders must prove it’s sourced, seasoned, and acceptable under anti–money laundering rules and loan guidelines. If you want a smooth closing, treat every big deposit