Explore The Latest News and Advice

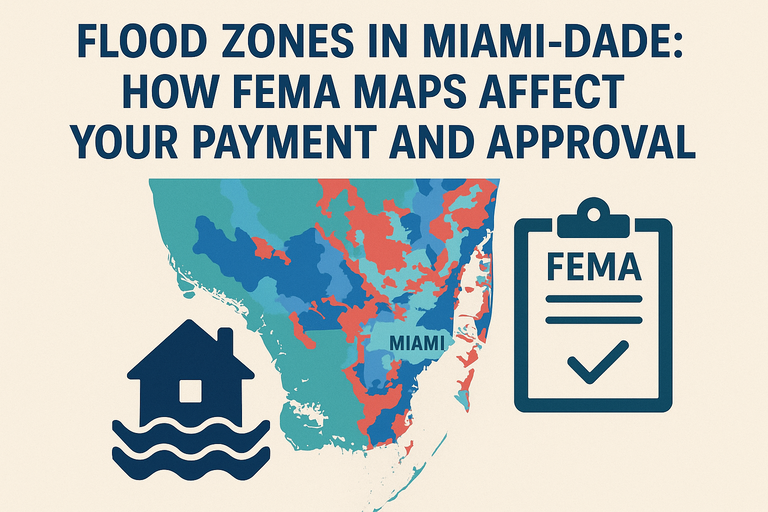

Flood Zones in Miami-Dade: How FEMA Maps Affect Your Payment and Approval

In Miami-Dade, your flood zone isn’t trivia—it can change your monthly payment, your cash-to-close, and sometimes your ability to close on time. Lenders don’t “prefer” flood insurance. In many cases, they’re legally required to make sure it’s in place before funding. Here’s how FEMA maps drive the outcome and what

Wind Mitigation Reports: How They Reduce Insurance (and Improve Mortgage Approval Odds)

In Miami, a wind mitigation report isn’t “nice paperwork.” It can directly lower your homeowners insurance premium and, more importantly, reduce the chance your mortgage gets delayed because insurance comes in too expensive or too slow. A wind mitigation inspection documents hurricane-resistance features using Florida’s Uniform Mitigation Verification Inspection Form

Special Assessments in Condos: How Lenders Treat Them (and How Buyers Should Negotiate)

A special assessment in a Miami condo isn’t automatically a deal-killer. But it is a signal to lenders that the building may have financial stress, deferred maintenance, or insurance/budget problems. And lenders treat signals like that with one response: more scrutiny. If you want to close on time, you need

Pre-Approval vs Pre-Qualification in Miami: What Sellers Actually Respect in 2026

In Miami, “I’m pre-qualified” is often treated like “I clicked a button online.” Sellers don’t care about your optimism. They care about certainty, speed, and low fall-through risk—especially when multiple offers hit the table. Here’s the real difference between pre-qualification and pre-approval, and what makes a seller take your offer

Underwriting Conditions Explained: The Top 20 “Suspense Items” and How to Clear Them Fast

Underwriting conditions (often called “suspense items”) are not personal. They’re the lender’s checklist to prove your loan meets guidelines. Most delays in Miami happen because borrowers respond slowly, send partial documents, or trigger new questions with sloppy uploads. Your goal is simple: clear conditions in one clean round. Here are

Gift Funds in Florida: Rules, Paperwork, and the Mistakes That Blow Up Underwriting

Gift funds can make a Miami purchase possible—but only if you treat them like underwriting will: verified, documented, and traceable. The fastest way to delay (or kill) a loan is sloppy gift paperwork, mystery transfers, or “we’ll explain it later” logic. Florida isn’t special here. The rules are driven by