Explore The Latest News and Advice

Construction-to-Permanent Loans in Miami: Build, Pay, and Convert Without Two Closings

A construction-to-permanent loan (often called a “one-time close”) is designed for buyers who want to finance the land (or lot) + construction costs now, then automatically convert into a long-term mortgage when the home is finished—without doing a second closing. It’s powerful. It’s also one of the easiest loans to

Jumbo Loan Underwriting in Miami: Reserves, Assets, and What Triggers Extra Scrutiny

Jumbo loans are portfolio loans (not sold the same way conforming loans are), so underwriting is stricter for one reason: the lender is taking more concentrated risk. In Miami, that risk gets amplified by condos, insurance volatility, and large asset movements. Here’s what underwriters focus on, what “reserves” really mean,

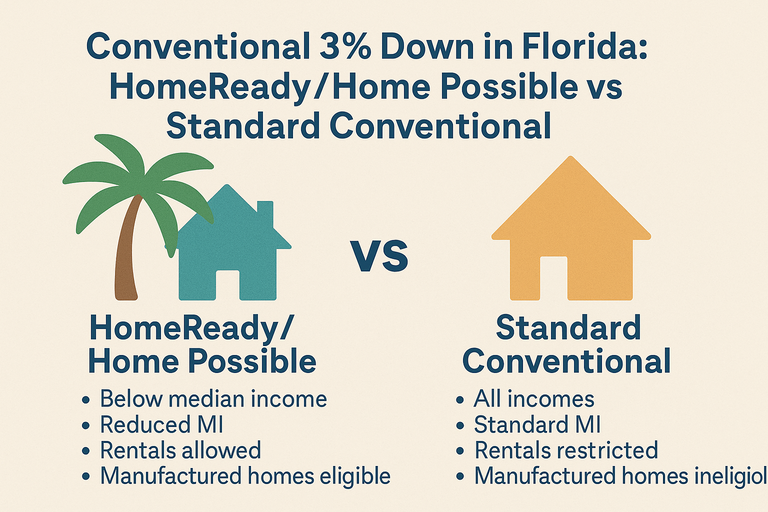

Conventional 3% Down in Florida: HomeReady/Home Possible vs Standard Conventional

If you’re shopping “3% down” in Florida, you’re really choosing between two buckets: Affordable-lending conventional (HomeReady / Home Possible) Standard conventional at 97% LTV (often called “Conventional 97”) They can look identical on a pre-approval letter. Underwriting doesn’t treat them the same. The quick difference (what most buyers miss) HomeReady

VA Loans in Miami: Residual Income, Condo Rules, and the Truth About “Zero Down” Costs

VA loans are one of the best benefits in housing—but Miami is where sloppy assumptions get expensive. The three places buyers get blindsided are residual income, condo approval, and thinking “zero down” means “no money needed.” 1) Residual income: VA’s real affordability test Most loan programs obsess over DTI. VA

FHA Condo Loans in Miami: Approval Lists, Spot Approvals, and Common Denial Reasons

FHA can be a great path for Miami condo buyers—but only if the condo project (or your single unit) meets FHA rules. The #1 mistake is going under contract first and “hoping it’s FHA-approved.” That’s how timelines blow up. 1) How to check if a Miami condo is FHA-approved (the

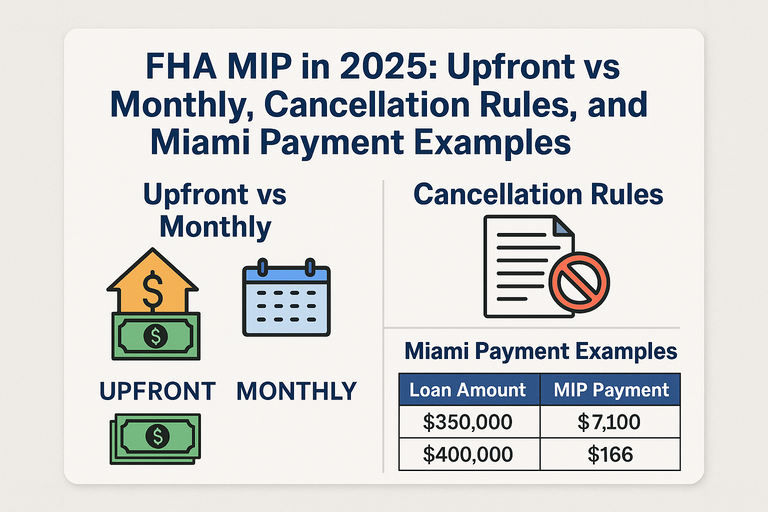

FHA MIP in 2025: Upfront vs Monthly, Cancellation Rules, and Miami Payment Examples

FHA mortgage insurance (MIP) has two separate charges: an upfront fee at closing and an annual fee paid monthly. People mix these up—and that leads to bad payment expectations. 1) Upfront MIP (UFMIP): the one-time charge For most FHA forward loans, the Upfront MIP is 1.75% of the base loan