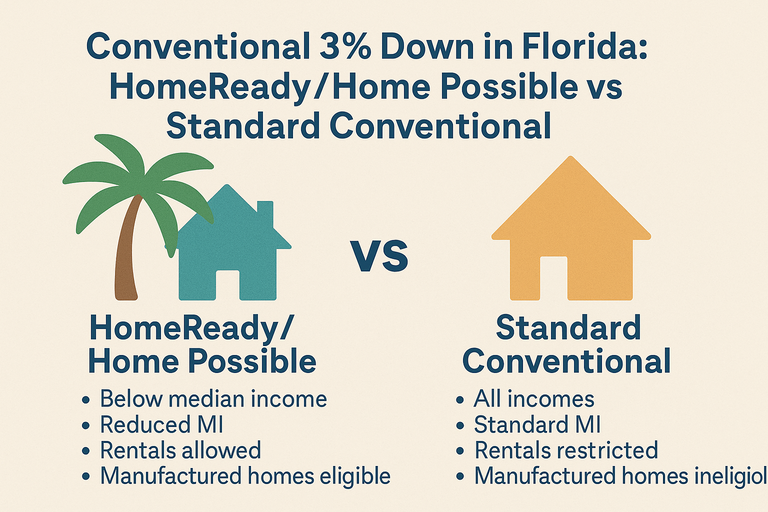

If you’re shopping “3% down” in Florida, you’re really choosing between two buckets:

- Affordable-lending conventional (HomeReady / Home Possible)

- Standard conventional at 97% LTV (often called “Conventional 97”)

They can look identical on a pre-approval letter. Underwriting doesn’t treat them the same.

The quick difference (what most buyers miss)

HomeReady (Fannie Mae) / Home Possible (Freddie Mac)

Built for low-to-moderate income borrowers, typically with:

- 3% down minimum

- Income limits (commonly tied to Area Median Income tools)

- Homebuyer education requirement in many first-time buyer situations

- Potentially better pricing/MI advantages for qualifying borrowers (depends on lender + profile)

Standard Conventional 97% LTV (“Conventional 97”)

Built for first-time homebuyers who want 3% down without the affordable-program income cap (or who don’t qualify for it). Fannie Mae’s 97% LTV options are specifically designed to support first-time buyers.

Eligibility: who actually qualifies

1) Income limits

- HomeReady/Home Possible: income limits are a core feature; you generally need to be within the program’s threshold based on location (check the official AMI tools/maps).

- Standard 97: aimed at first-time buyers and is often used when the borrower exceeds HomeReady limits. (FDIC)

Miami reality: Two buyers can have the same credit and down payment. The one just above the AMI cap gets pushed to Standard 97, and pricing can shift.

2) First-time homebuyer requirement

- Standard 97: generally requires at least one borrower to be a first-time homebuyer.

- HomeReady/Home Possible: can be used by first-time or repeat buyers depending on specifics, but education requirements often kick in when all borrowers are first-time.

3) Property type (where Florida buyers get tripped up)

For Fannie Mae’s 97% LTV options, eligibility is tied to a 1-unit principal residence (with certain eligible property types noted by Fannie).

Condo eligibility can also be its own separate gate (project approval), especially in South Florida.

Down payment + funds: what’s allowed

All three (HomeReady, Home Possible, Standard 97) are conventional loans, so you’re dealing with PMI (not FHA MIP). PMI can be canceled later once you reach enough equity under the normal rules, unlike many FHA scenarios.

Also: 3% down does not mean 3% total cash. You still need closing costs + prepaid escrows (taxes/insurance), and in Florida those can be painful.

For budgeting help, you can interlink:

Homebuyer education: annoying, but it can save your closing

HomeReady has a defined homebuyer education requirement process (Fannie Mae HomeView is a common path).

Home Possible also requires homeownership education in certain first-time homebuyer situations (Freddie cites CreditSmart Homebuyer U as a free option).

Don’t procrastinate. If you wait until underwriting conditions, you’re volunteering for delays.

Which one is “better” in Florida?

Here’s the blunt decision rule:

Pick HomeReady/Home Possible when:

- You fit the income limits (by the official tools), and

- You want every pricing/MI advantage available to qualified LMI borrowers, and

- You’re okay completing the education requirement early.

Pick Standard 97 when:

- You’re a first-time buyer but don’t meet the income limits (or the lender can’t make the affordable product work cleanly), and

- You still want 3% down on a 1-unit primary residence.

Hard truth: plenty of lenders will shove you into the version that’s easiest for them to run, not what’s cheapest for you long-term. Force them to quote both.

To keep lenders honest, interlink:

What to ask your lender (so you don’t get quietly upsold)

- “Can you price this as HomeReady and as Standard 97 and show me the PMI difference?”

- “Does this property type qualify at 97% LTV?”

- “Do I need homebuyer education for this program—and can I knock it out today?”

- “What cash-to-close should I plan for besides the 3% down?”

Bottom line

HomeReady/Home Possible are 3% down options designed around income-based affordability rules. Standard Conventional 97 is 3% down mainly for first-time buyers who may not fit those income caps. Your best move is to make your lender compare both—side-by-side—before you commit.