Buying a home in Orlando is an exciting step — but even small mortgage mistakes can cost thousands over time. Whether you’re a first-time buyer or upgrading to a larger property, understanding what not to do is just as important as knowing the right steps.

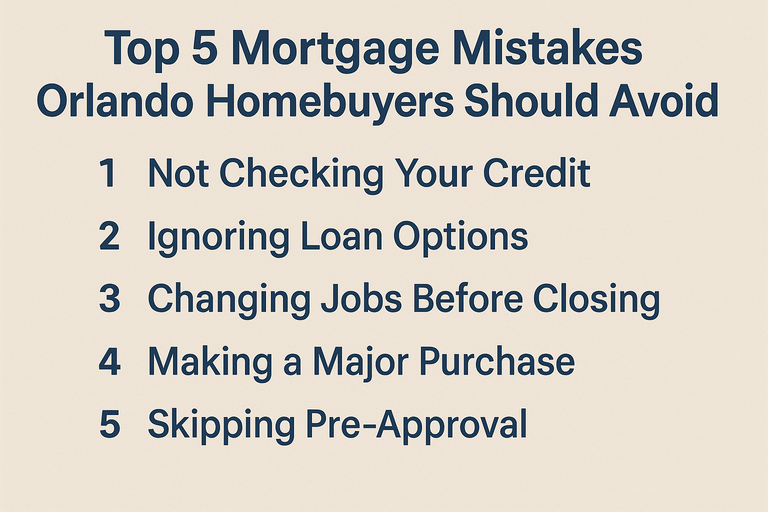

Here are the top five mortgage mistakes that Orlando homebuyers should avoid in 2025, along with expert advice to help you make smart financial moves.

1. Not Getting Preapproved Before House Hunting

Many buyers start shopping for homes without getting preapproved for a mortgage first. This can lead to wasted time, disappointment, or even losing your dream home in a competitive market.

Why it matters:

-

Preapproval shows sellers you’re a serious, qualified buyer.

-

It helps you understand exactly how much you can afford.

-

It speeds up closing once your offer is accepted.

Tip:

Work with a Florida mortgage broker who can get you preapproved in just a few days, helping you make strong offers in Orlando’s fast-paced real estate market.

2. Ignoring Your Credit Score

Your credit score directly affects your mortgage rate and approval chances. Too many Orlando buyers overlook their credit history until it’s too late.

Why it matters:

-

A 740+ score typically earns the lowest interest rates.

-

A lower score can cost tens of thousands in extra interest.

Tip:

Before applying, review your credit report, pay down credit card balances, and avoid opening new accounts. Even a small score increase can reduce your monthly payments.

3. Making Major Purchases Before Closing

It’s tempting to buy new furniture or a car before moving into your Orlando home — but doing so can jeopardize your loan approval.

Why it matters:

-

Large purchases increase your debt-to-income ratio.

-

New credit inquiries can lower your score.

-

Lenders recheck credit before closing.

Tip:

Wait until after you’ve closed on your home to make big purchases. Focus on maintaining stable finances during the mortgage process.

4. Choosing the Wrong Loan Type

Not all loans are created equal. Some buyers automatically choose a conventional loan when an FHA, VA, or bank statement mortgage might be better.

Why it matters:

-

The wrong loan type could lead to higher payments or unnecessary fees.

-

VA loans offer major benefits for eligible veterans.

-

Self-employed borrowers may need flexible options.

Tip:

Discuss your situation with a mortgage broker who understands all loan programs — including FHA, VA, jumbo, and self-employed options — to find the best fit for your Orlando home purchase.

5. Failing to Compare Rates and Lenders

One of the biggest mistakes homebuyers make is sticking with the first lender they find. Mortgage rates and fees can vary significantly between lenders.

Why it matters:

-

A 0.25% rate difference can save or cost you thousands.

-

Some lenders charge hidden origination or processing fees.

Tip:

Use a broker like My Miami Mortgage Broker, who can compare multiple lenders and negotiate better terms on your behalf.

Bonus Tip: Not Budgeting for Florida’s Homeownership Costs

Beyond your mortgage payment, remember to factor in property taxes, insurance, and maintenance costs, especially for Florida’s tropical climate.

Flood insurance and hurricane coverage may be required, so it’s wise to budget early and plan for annual expenses.

Final Thoughts

Avoiding these five common mortgage mistakes can make your homebuying experience in Orlando smoother, faster, and far more affordable.

By getting preapproved, maintaining good credit, choosing the right loan type, and comparing lenders, you’ll position yourself for long-term success and savings.

If you’re ready to buy in Orlando or anywhere in Florida, contact My Miami Mortgage Broker today for expert guidance and personalized loan solutions.