Choosing the right mortgage broker can be the difference between saving thousands on your loan — or overpaying. In Miami’s competitive housing market, buyers need a broker who not only shops the best rates but also understands local challenges like condo rules, flood zones, and insurance costs.

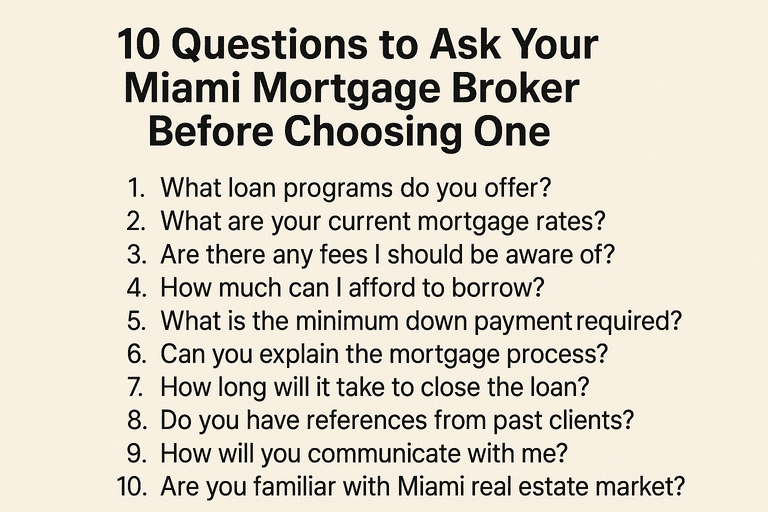

Before committing, make sure you ask the right questions. Here are 10 essential questions every Miami homebuyer should ask a mortgage broker in 2025.

1. How many lenders do you work with?

The more lenders a broker has access to, the more loan options you’ll have. Look for brokers connected to dozens of lenders, not just a handful.

2. What loan programs do you specialize in?

Miami buyers range from first-time homeowners to luxury investors. Make sure your broker is experienced with programs like FHA, VA, jumbo loans, foreign national loans, and self-employed borrower solutions.

3. How do you get paid?

Most mortgage brokers earn a small commission from the lender. A trustworthy broker will be transparent about their fees and ensure you don’t pay more than necessary.

4. Can you help me compare rates and terms across lenders?

Your broker should provide a side-by-side comparison so you can clearly see rates, fees, and terms before making a decision.

5. Do you have experience with Miami condos?

Condos make up a large portion of Miami’s housing market, but financing them can be tricky due to reserve requirements and HOA rules. Make sure your broker knows how to handle condo loans.

6. What documents will I need to provide?

A good broker will explain upfront what’s required — from tax returns and pay stubs to bank statements or alternative documentation for self-employed buyers.

7. Can you help me estimate closing costs in Miami?

Florida has unique costs, such as doc stamps and intangible taxes. Your broker should provide a detailed closing cost estimate so there are no surprises.

8. How do you handle communication during the process?

Buying a home is stressful. Ask how often the broker will update you and whether you’ll have a direct point of contact.

9. Can you help me qualify for down payment assistance programs?

Many first-time buyers in Miami don’t realize they qualify for state or county assistance. The right broker will help you explore these options.

10. Why should I choose you over another Miami mortgage broker?

This is the big one. Your broker should confidently explain their experience, lender access, and local expertise — and why that benefits you.

Why Asking Questions Matters

Not all brokers are created equal. Asking the right questions ensures you:

-

Work with someone experienced in Miami’s unique real estate market.

-

Avoid unnecessary fees or delays.

-

Get access to loan programs tailored to your needs.

Conclusion

Your mortgage broker is your partner in one of the biggest financial decisions of your life. By asking these 10 questions, you’ll know whether they have the expertise, transparency, and resources to get you the best possible deal.

A Miami mortgage broker should save you time, money, and stress — not add to it.

👉 Ready to ask us these questions (and hear the right answers)? Contact My Miami Mortgage Broker today for a free consultation.