Millennials and Gen Z are shaping the future of Miami’s housing market. With many entering their prime homebuying years, these generations are eager to invest in property — but face unique challenges, from student debt to high housing costs.

Despite these obstacles, there are new mortgage programs, creative financing solutions, and market trends in 2025 that make homeownership more accessible than ever. With the guidance of a Miami mortgage broker, younger buyers can find tailored solutions to achieve their real estate goals.

Challenges Younger Buyers Face in Miami

-

High Property Prices – Miami’s booming market pushes many starter homes out of reach.

-

Student Loan Debt – Affects debt-to-income (DTI) ratios and mortgage qualification.

-

Rising Rents – Makes saving for a down payment more difficult.

-

Limited Credit History – Many younger buyers don’t have long credit profiles.

-

Gig Economy Employment – Freelancers and self-employed workers may struggle with traditional documentation.

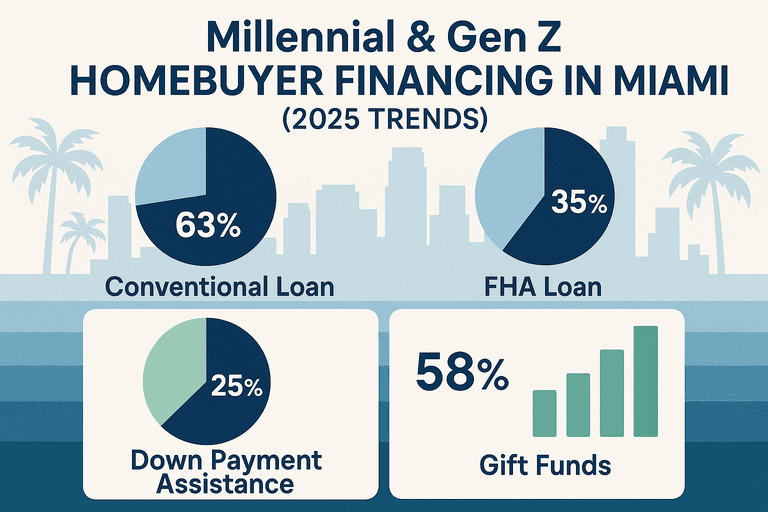

Mortgage Options for Millennials & Gen Z

-

FHA Loans – Just 3.5% down with flexible credit requirements.

-

Conventional 3% Down Loans – Designed for first-time homebuyers with solid credit.

-

Down Payment Assistance Programs – Miami-Dade and Florida offer grants to reduce upfront costs.

-

Bank Statement Loans – For self-employed buyers or those with non-traditional income.

-

Shared Equity Programs – Some lenders partner with investors to lower initial costs.

-

USDA & VA Loans – Available for eligible buyers outside urban cores or veterans.

2025 Trends Shaping Millennial & Gen Z Homebuying in Miami

-

Rise of Co-Buying: Friends or family members purchasing homes together to split costs.

-

Smaller Condos & Starter Homes: Preference for affordable units close to city centers.

-

Focus on Affordability Tools: Using mortgage calculators and affordability planners before committing.

-

Preference for Green & Smart Homes: Eco-friendly mortgages and tech-enabled living appeal to younger buyers.

-

Remote Work Influence: Expanding the range of neighborhoods considered, including suburban options like Homestead or El Portal.

How a Mortgage Broker Helps Younger Buyers

A Miami mortgage broker provides critical support by:

-

Explaining complex mortgage terms in plain language.

-

Identifying programs with low down payments and flexible credit rules.

-

Helping apply for down payment assistance grants.

-

Guiding self-employed buyers toward alternative documentation loans.

-

Shopping multiple lenders to find the most affordable option.

Step-by-Step: Path to Homeownership for Younger Buyers

-

Consultation: Review income, savings, and goals with a broker.

-

Pre-Approval: Strengthen offers in Miami’s competitive housing market.

-

Loan Shopping: Compare FHA, conventional, and alternative loan programs.

-

Assistance Programs: Apply for grants to reduce upfront costs.

-

Closing: Navigate inspections, insurance, and title requirements with expert guidance.

Conclusion

Millennials and Gen Z may face hurdles, but with the right strategy, homeownership in Miami is within reach in 2025. From low down payment loans to innovative programs, today’s buyers have more options than ever.

A Miami mortgage broker helps younger buyers cut through the noise, secure the best financing, and turn the dream of homeownership into reality.

👉 Are you a Millennial or Gen Z buyer ready to own in Miami? Contact My Miami Mortgage Broker today and discover the financing options that fit your lifestyle.