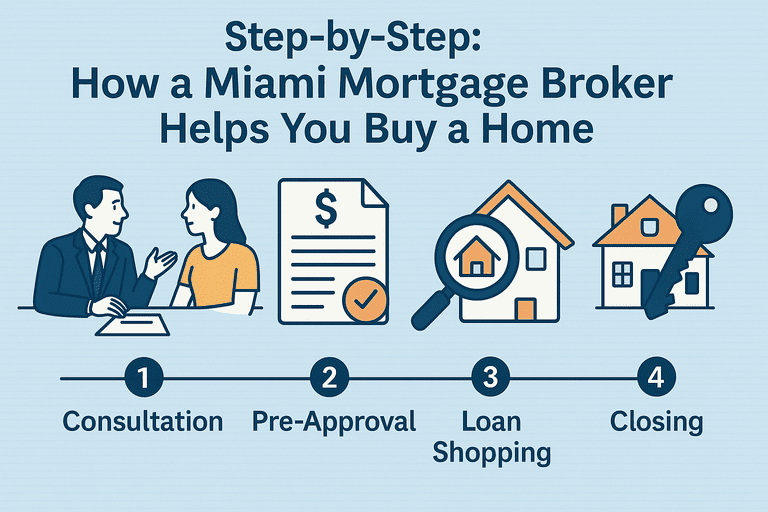

Buying a home in Miami’s vibrant and competitive real estate market is an exciting milestone, but navigating the mortgage process can feel like a daunting maze. From understanding credit requirements to managing piles of paperwork and deciphering closing costs, the journey to homeownership is complex. This is where a Miami mortgage broker becomes an invaluable partner. Unlike a bank lender who represents a single institution, a mortgage broker acts as an intermediary, connecting you with multiple lenders to find the best loan terms for your needs. In this comprehensive guide, we’ll walk you step-by-step through the process of working with a Miami mortgage broker, so you know exactly what to expect and how they can simplify your path to owning a home in 2025.

Step 1: Initial Consultation

The first step in working with a Miami mortgage broker is the initial consultation, a crucial meeting where the broker gets to know you and your financial goals. During this stage, the broker will thoroughly review your financial situation, including your credit score, income, savings, and debt-to-income (DTI) ratio. These factors determine your eligibility for various loan programs and influence the interest rates you’ll be offered.

You’ll also discuss your homebuying objectives. Are you a first-time buyer looking for an affordable starter home in neighborhoods like Kendall or Dade? Are you eyeing a luxury condo in Miami Beach or an investment property in Wynwood? Perhaps you’re a foreign national seeking financing for a second home in Coral Gables. A skilled broker tailors their approach to your specific goals, explaining the range of loan programs available in Miami, such as FHA loans for low down payments, VA loans for veterans, or jumbo loans for high-value properties. This personalized consultation sets the foundation for a smooth mortgage process.

Step 2: Pre-Approval

Once you’ve outlined your goals, the next step is securing a pre-approval, a critical advantage in Miami’s fast-paced housing market. A pre-approval letter signals to sellers that you’re a serious buyer with verified financing, giving you a competitive edge in bidding wars.

Your mortgage broker will guide you in gathering essential documents, such as W-2s, pay stubs, bank statements, tax returns, and proof of assets. They’ll then submit your application to multiple lenders, leveraging their network to find the best fit for your financial profile. This process typically takes a few days, depending on the complexity of your finances. Once approved, you’ll receive a pre-approval letter specifying the loan amount you qualify for, which is especially important in Miami, where homes in desirable areas like Brickell or Coconut Grove often attract multiple offers. Your broker ensures this step is completed efficiently, positioning you to act quickly when you find the right property.

Step 3: Rate Shopping

One of the biggest advantages of working with a Miami mortgage broker is their ability to shop for the best interest rates and loan terms across multiple lenders. Unlike a bank lender, who offers only their institution’s products, a broker has access to a wide network of lenders, including banks, credit unions, and private institutions. This allows them to compare options like FHA, VA, USDA, jumbo, and conventional loans, as well as specialized programs for self-employed buyers or foreign nationals—a common demographic in Miami’s diverse market.

Your broker will present you with a range of loan options tailored to your financial situation, explaining the pros and cons of each. For example, they might recommend a fixed-rate mortgage for stability or an adjustable-rate mortgage (ARM) for lower initial payments. By securing the lowest possible interest rate and favorable terms, a broker can save you thousands of dollars over the life of your loan, making this step a key benefit of their expertise.

Step 4: Loan Application Support

Submitting a complete and accurate loan application is critical to avoiding delays in the mortgage process. Your Miami mortgage broker acts as your advocate, ensuring all paperwork is properly completed and submitted on time. This includes verifying that documents like income verification, employment history, and credit reports are in order.

The broker also serves as a liaison between you, the lender, and your real estate agent, streamlining communication to keep the process moving forward. They’ll explain complex loan terms, such as points, origination fees, and escrow requirements, in clear language, so you fully understand your obligations. Throughout the underwriting process, where lenders assess your application in detail, your broker provides updates and addresses any issues that arise, such as requests for additional documentation. This hands-on support minimizes stress and helps ensure a timely approval.

Step 5: Closing Coordination

The final step in the homebuying process is closing, where you sign the paperwork to finalize your mortgage and take ownership of your new home. A Miami mortgage broker plays a pivotal role in coordinating this stage, working closely with the title company, appraiser, and lender to ensure everything is in place for a smooth closing day.

Your broker will review the Closing Disclosure, a document outlining your loan terms, monthly payments, and closing costs, to confirm there are no surprises. They’ll also help schedule the appraisal, which is critical in Miami’s market, where property values can vary widely by neighborhood. By staying on top of deadlines and requirements, your broker ensures that all parties are aligned, reducing the risk of last-minute hiccups. On closing day, they may even attend to answer any final questions, providing peace of mind as you sign the dotted line.

Conclusion

Working with a Miami mortgage broker in 2025 offers a personalized, efficient, and cost-effective way to navigate the complex mortgage process. From the initial consultation to closing day, a broker’s expertise, access to multiple lenders, and hands-on support make them an invaluable ally for homebuyers.

Whether you’re purchasing a condo in Downtown Miami, a family home in Palmetto Bay, or an investment property in Little Havana, a mortgage broker can help you secure the best loan terms and guide you every step of the way. By simplifying paperwork, comparing rates, and coordinating with all parties, they turn the dream of homeownership into a reality with confidence and ease.